What is Cap Rate?

In this section, we will explore common yet essential questions and answers regarding Cap Rate. We will expand our discussion to cover topics related to the cap rate for a more in-depth understanding of what cap rate is and isn't. After all, understanding and correctly using cap rate calculations are an integral part of a real estate investor tools, either if it a real estate investor purchasing a single property or the VP of Investments at a large Real Estate Investment Trust (REIT).

What does Cap Rate Mean?

Cap rate is the abbreviation for Capitalization rate. The capitalization rate is a formula used to estimate the potential return an investor will have on a real estate property. The method calculates the ratio of the properties Net Operating Income (NOI) to the property asset value. The NOI value is usually the actual NOI of the property over the period of one year. The amount used for the properties asset value is often the asking sales price for the property or the purchase price the investor is expecting to pay for the property. Therefore the Cap Rate informs the investor of the potential rate of return for investing in a specific real estate property. I.e., Potential future NOI dollars for every dollar invested in acquiring the property.

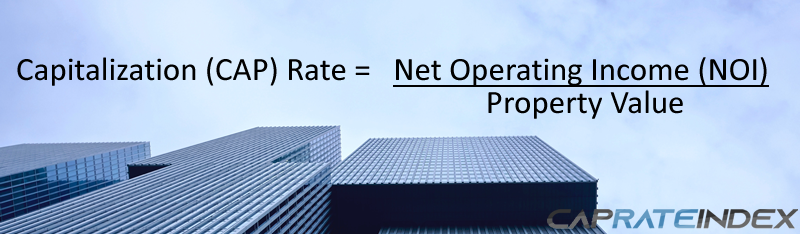

What is the Cap Rate formula?

The formula for Capitalization rate is: Cap Rate = Net Operating Income (NOI)/ Property Value.

If you have two of the three variables of the Cap rate formula, you can determine the third variable. So you can also use the Cap Rate formula to determine the expected NOI or property value depending on which variables you have.

Calculating Property Value (PV) from Cap Rate

To determine what the asking price for a property should be according to the cap rate, you can divide the NOI value provided by the seller by the capitalization rate in the region for that type of property. This will allow you to compare the actual asking price to your estimated property value and determine if the asset is worth what is being asked compared to other investment opportunities. Of course, at the end of the day, the seller is the one who determines what they are willing to let go of the property for, which may be different from the cap rate estimated property value. Likewise, you as the investor determine if you are willing to pay the amount being asked by the seller or the value calculated by the Cap Rate formula, or a different value altogether.

Calculating the expected Net Operating Income (NOI)

You can calculate the expected NOI you would receive annually for a property by multiplying the properties asking price by the cap rate in that region for a specific type of property. This will allow you to make some initial estimates on the potential NOI’s, profits and returns you may have from this property, and determine if you would like to pursue this lead further. Once you receive the actual NOI value from the current property owner, you can compare your estimated NOI to the actual NOI, to determine if the asking price makes sense for your investment model.

What is the purpose of the Cap Rate calculation?

The Cap Rate calculation allows you to determine how much you are paying for a property’s Net Operating Income (NOI), enabling you to compare this cap rate (ratio) to other investment property opportunities.

How does Cap rate determine value? Moreover, what does Cap Rate tell us about the investment property?

Let’s discuss two definitions of “value” which cap rate will help you determine. The first is the value the market identifies the property is worth, and the second is the value you define the property is worth for your investment style and model. For the first, by knowing the cap rate the market has established for that type of property in that region (e.g., Class B Office building in Phoenix, Arizona), you can then calculate the property value by comparing the properties (NOI) to the cap rate. This will let you compare the price for the property to the amount you calculated from the cap rate, and determine if the asking price is above, below or equal to the estimated value. Second, the Cap Rate calculation determines the property value you are willing to pay by calculating the NOI of the property to the Cap Rate that fits your investment style and model. You can then compare what you are expecting to pay for that property to the asking price, and determine if it is priced within your expectations.

Why is the cap rate so important to investors?

As investors, we are always comparing different investments opportunities and the potential returns, since one of our objectives as investors it to maximize our returns. The cap rate allows us to benchmark the expected returns for a specific asset type within a particular region during a specified period, to determine if we will be doing better, worst or inline with investments in other properties.

The cap rate also allows us to see improvement opportunities in a property. You may purchase an asset with a poor NOI since the property is not in great shape, but the property may present opportunities for improvement to its NOI with some additional investment or development.

Example, you identify a property with an NOI of $100,000 a year, and the owner of the property is asking $1,000,000 for the property, which is a Cap Rate of 10%. Yet you recognize that with an investment of approximately $200,000 in improvements to the property, you can raise that NOI to $150,000 per year. That would mean that you are acquiring a property with a cap rate at 10%, and after your improvements, the property can have a cap rate of 12.50%. So you were able to improve the cap rate of this property be generating a higher annual return from your investment into this property. This may be an opportunity other investors overlooked due to the listed cap rate, but you can see some upside in the venture.

What does a negative cap rate mean?

A negative cap rate is the result of a negative Net Operating Income. If the property you are seeking to acquire has high operating expenses which can not be covered by the properties revenues, then the property will have a negative NOI, resulting in a negative cap rate. For example, the property had -$50,000 in NOI during the year, and the asking price is $600,000. The Cap rate for this property is -%8.33.

How accurate is the Cap Rate or the NOI?

It is essential to take a close look at the Cap Rate and NOI being presented for a property listed for sale. Some property sellers may list a property asking price, Cap Rate and NOI based on a potential future projected NOI. For example, a property owner may have a property which is currently vacant, partially vacant or charging below-market rent. However, the property owner is listing the property with the “expected” or “achievable” NOI instead of the actual. The property owner’s argument may be that with some work, renovation, or by merely adjusting the rents to market value, the expected NOI will be achieved. Therefore the current property owner is asking for a higher price on the property since he or she is dividing a higher than actual NOI by the current market cap rate. If the potential investor is not aware of this difference, they may pay more than they expect for a property which will provide a smaller than anticipated NOI or cash flow.

This leads us the next question which is, how exactly is Net Operating Income calculated.

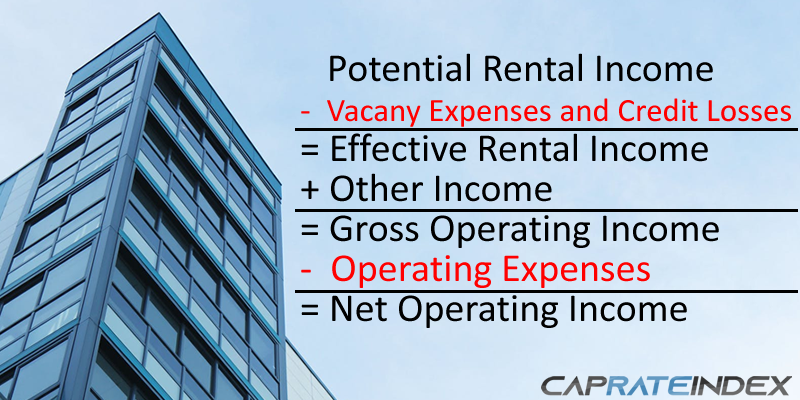

How is Net Operating Income calculated, what is the formula?

The NOI may be calculated differently, some may calculate the Cap Rate and NOI based on the trailing three month, six months, or one year while others may use a projected NOI for the next twelve month (i.e., Pro-forma) based on forecasted revenues and expenses, etc.

To calculate the Net Operating Income, start with the Potential Rental Income which is the total potential revenues the property can generate if 100% rented. Let’s use the example of John, an investor, looking to acquire a residential building in Chicago which has 300 units that can be rented at $24,000 per unit per year. The Potential Rental Income is $7,200,000 ($24,000 x 300 units) per year. Next, subtract the Vacancy Expenses and Credit Losses from the Potential Rental Income. The Vacancy Expenses and Credit Losses is the percentage of the expected Potential Rental Income which is expected not to be received due to units not renting (vacant) and due to lack of rent payment by the tenant. An investor or property owner can consider the historic Vacancy Expenses and Credit Losses to predict future values, but should also consider future factors such as market downturns. For example, depending on the property’s region, type, and class, and depending on the economy and market cycle this Vacancy Expenses and Credit Losses can normally represent anywhere from 3% to 7% of the Potential Rental Income.

However, if during difficult economic periods or if the building is below market quality for its regions, these number can be even higher in the 10%, 20%, 30% range. So for our Chicago building example, let us assume a 3% Vacancy Expenses and Credit Losses, representing $216,000 ($7,200,000 x 0.03). Subtracting the Vacancy Expenses and Credit Losses ($216,000) from the Potential Rental Income ($7,200,000), John has an Effective Rental Income of $6,984,000. John can then add any additional income the company expects to generate from this property such as services offered in the building (e.g.; rental of common areas for events, laundry machines, vending machines, parking lots, pets fees, etc), which based on historical values John can estimate the Other Incomes for this Chicago residential building to be $21,000 a year. The Gross Operating Income for the property, which is the Effective Rental Income ($6,984,000) plus Other Incomes ($21,000) is then $7,005,000 per year.

Next, John calculates the Operating Expenses. The Operating Expenses includes but are not limited to insurance, management expenses (e.g., accounting, legal, property management, licenses), repair and maintenance, marketing and advertising fees, cleaning services, utilities (electric, gas, water & sewage, internet, telephone, cable), and taxes (property and personal). Using historical data provided by the current property owner and making his own research and analysis, John estimates the Operating expenses to be $2,210,600. Therefore, John can estimate the Net Operating Income (NOI) to be $4,903,500, by subtracting the Operating expenses ($2,210,600) from the Gross Operating Income ($6,984,000).

Does Cap Rate Include debt service?

The Cap rate formula does not include debt service (i.e., mortgage payments) since the NOI in the calculation does not account for debt services. This is because mortgage payments may vary between different investors and also the current property owner. So if the NOI was considering for debt services it may not reflect as accurate a picture for a different investor who will have different financial terms for financing.

Does Cap Rate include property management fee?

Yes, the property management fee is a part of the Cap Rate formula. The Property Management fees are factored in the Net Operating Income calculation, accounted for in the Operating Expenses (OpEx) category. However, it is critical to verify that the NOI calculations presented by the current property owner include all the proper expenses in the OpEX category and the Capital Expenses (CapEx) category.

Is Cap Rate the same as ROI?

Cap Rate is not the same thing as Return on Investment (ROI), as the NOI in the cap rate formula does not account for many items such as capital expenditures (CapEx), depreciation or amortization, mortgage payments, and more. Therefore, the cap rate should not be considered as the investors return on the investment in a property.

Is Cap Rate the same as IRR?

Cap Rate and Internal Rate of Return (IRR) are not the same thing. Although both Cap Rate and IRR can be used to measure the attractiveness of investing in a real estate project, they are fundamentally different. The IRR takes into account the time value of money, while the Cap rate is a snapshot of one period. The IRR is a discount rate that makes the Net Present Value (NPV) of all the cash flows from the investment property, either positive or negative, equal to zero.

What is a good Cap Rate?

There is no specific cap rate which is good or bad. Cap rate will vary by region (street, neighborhood, zip code, city, district, state, etc.), by property type (residential, retail, commercial, industrial, etc.), by class (high-end, mid-market, low-end, also known as Class A, B,C), by the condition of the property (brand new, renovated, derelict, etc). For an investor, the critical point is to acquire the property at a competitive cap rate compared to the what is the markets cap rate for that type of property. In other words, you don't want to pay more for the property than what the market would consider the fair price for that property.

Is a high or low cap rate better?

For the investor trying to acquire a property, it is more interesting than the properties purchase price is evaluated at a higher Cap Rate since that will mean the investor can pay less for the properties annual NOI. For the property owner, selling the property with a lower cap rate is more interesting since it means the owner can charge a higher price for the property with the same annual NOI.

Let’s take an example. Sarah has put for sale her MultiFamily building located in New York, NY which generates an NOI of $400,000 a year. Let's consider for this example that the average cap rate for her type of property in her neighborhood has a market average cap rate of 4%.

For Sarah the property owner, it is more interesting than the cap rate be considered at 3.5%, which would mean she can have an asking price of $11,428,571. Calculation: (Property value = NOI/Cap Rate = $400,000/0.035 = $11,428,571).

For John the investor, it is better to acquire this property with a market cap rate of 5%, since it would mean he only has to pay $8,000,000 for the same property. Calculation: (Property value = NOI/Cap Rate = $400,000/0.05 = $8,000,000).

So a higher or lower cap rate will be better depending if you are the buyer or the seller of the property, as discussed in the above example. Although the market established some expected cap rate parameters, there is no fixed or specified Cap rate. Therefore, as in the above case, there is room for variation and the negotiated Cap Rate.

Is Cap Rate and Yield the same thing?

Cap Rate and Yield are not the same thing. Yield is more commonly associated with the interests earned from a security, such as Bond yield and a stock’s dividends. For example, REIT’s pay a monthly or quarterly dividend distribution, and the REIT’s dividend yield can be calculated by dividing the annualized value of those dividend distributions by the REIT’s stock price at a specific period. So for instance, if a REIT is paying 25 cents per share per quarter, it is distributing $1 annually ($0.25 x 4 quarters). If one share (stock) of that REIT costs $10 than the forward-annualized yield of that REIT is 10% ($1 in dividend distributed / $10 stock price).

What is the 1% Rule in real estate and is it similar to cap rate?

Cap Rate and the 1% Rule are not similar to each other. The 1% rule, is a rule of thumb, or back of the envelope calculation to determine if a real estate investment property will cover its mortgage payments. It is a quick way for the investor to determine if a mortgage payment terms (based on known or estimated fees) will cover an approximated potential monthly rental income. It is calculated by assuming you can charge monthly rents equivalent to 1% of the properties value. So if the property’s value is $300,000, you calculate that 1% is $3,000 ($300,000 x 0.01). So you are assuming you can charge rents of $3,000 each month ($36,000 per year). You can then compare it to the mortgage loan cost of that property to determine if the investment property monthly rent covers the mortgage payments, breaks even, or is not sufficient to cover the mortgage, in which case will require the investment to use additional sources of capital to service the loan. The objective of the 1% rule is that the rental income will be superior to or at the very least equal to the monthly mortgage payments.

What is the 2% Rule in real estate and is that related to cap rate?

Cap Rate and the 2% Rule are not related calculations. The 2% Rule is similar to the 1% rule described in the above paragraph. The difference is that the rule assumes that if a property generates monthly rental income equivalent to 2% or more of the properties value, then this property is a worthwhile investment. So for instance, using the earlier example if the property’s purchase price is $300,000, you calculate that 2% of that value is $6,000 ($300,000 x 0.02) in monthly rent per year. This again is a “back of the envelope” calculation which would assume this property will have the ability to cover its mortgage payment and additional expenses. This is just an initial estimate used by some real estate investors, and not the determining factor to decide on an investment.

What is the 50% rule and is it the same thing as the Cap Rate formula?

Cap Rate and the 50% Rule are not the same thing. The 50% rule is an quick calculation that states that approximately 50% of the rental income of a property will go to cover the expenses of the property, except for the mortgage payments. So the 50% Rule puts in question “Would the remaining 50% be sufficient to cover the mortgage payments and leave a profit for you the investor, or at the very least break even? The calculation would go something similar to this; the property generates $2,000 in monthly rents. Assuming 50% of that monthly rental income $1,000 ($2,000 x 0.50) goes to pay expenses, will the remaining 50%, $1,000, cover the mortgage payments and still leave you with something? As you can imagine this is a very rough rule of thumbs since it assumes that most property will have similar percentage of expenses leading up to a total of 50%. This 50% rule is used by some real estate investor to make a quick “off the top of the head” calculation if a property deserves a “second look” or a more in-depth analysis. However, it can also be a rule which leads the investor to lose out on excellent opportunities or to risk getting into bad investments.

What is the 70% rule in real estate and is this rule related to Cap Rate?

The 70% rule, is not related to Cap Rate. The 70% Rule is a rule of thumbs for investors considering to buy a property to repair and resell, also referred to as “Flipping a property.” The investor first determines what the expected market value of the property will be once it is restored (also known as the “After Repair Value” ARV), and what will be the estimated cost to repair that property (also known as the “Estimated Repair Cost” ERC). The 70% rule formula is (ARV x 0.70) - ERC = Max value that should be paid for the property by the investor. So let's say the investor determines the property’s market value will be $200,000 after it is repaired or restored and that the cost to repair it will be $25,000. The 70% rule is calculated as 70% of $200,000 is $140,000. Then $140,000 minus the $25,000 is $115,000. So the investor should pay no more than $115,000 to acquire this property to flip, to reduce the chances of losing money on this project.

Is Cap Rate the same thing as Cash flow?

No, Cap Rate is not the same thing as Cash Flow.

Is Net Operating Income (NOI) the same thing as Cash flow?

No, Net Operating Income (NOI) is not the same thing as the properties cash flow. To calculate the Cash Flow Before Taxes (CFBT) you need to subtract from the Net Operating Income (NOI) the Debt Services (mortgage payments) and Capital Improvements to the property and add back any interest earned and debt proceeds. To further calculate the Cash Flow after Taxes (CFAT) you subtract the Income Tax Liability from the Cash Flow Before Taxes. So as you can see the Cash Flow Before Taxes (CFBT) and Cash Flow After Taxes (CFAT) are not the same thing as the Net Operating Income (NOI).

What is Cap Rate Compression?

Cap Rate compression is when the price of a property raises while the NOI for the property stays the same, resulting in the cap rate of the property being pushed down (lower cap rate). This can usually be seen when investor demand for real estate is strong, and investors will bid higher to gain a property and accept a lower NOI in exchange for it. Cap Rate compression usually benefits the existing owner of a property since they can potentially sell it for a higher price in relationship to its NOI than when they acquired it. A Cap Rate compression usually lowers the return an investor will receive on a property. We commonly see Cap Rate compression when the economy is growing, interest rates are lower, rental demands are high, and investors have more access to capital, resulting in a sellers market. This can be a risky time for investors as they may end up paying higher prices to acquire a property with a low Net Operating Income.

Why would investors want a low cap rate?

An investor may be interested in a property with low cap rate because of the quality of the property, and stability of the monthly rental income it generates, and the prospect that the property value will continue to appreciate in the future. Although an investor may be paying more and receiving a lower NOI, the investor may determine that the overall return from investing in this property will be more secure or superior to investing in another property with a higher cap rate. Of course, it is important to note that just because a property has a low cap rate does not mean that it is a better quality investment property or has better prospects or returns. An asset may have a small cap rate just because it is overpriced, and therefore it is important to analyze a properties financials and market closely.

Which type of properties (Single Family homes, Multifamily, residential, commercial, retail, industrial) have the best cap rates?

There is no set rule that one specific type of property (e.g., Multifamily, single-family home, retail stores, shopping centers, industrial, office, hospitality, entertainment venues, etc.) will always have a better cap rate than another. The cap rate for these different properties will vary depending on the quality (e.g., Property Class A, B, C, D) of the property and its location. In some regions, offices and residential may have a lower cap rate than retail and industrial properties, yet in other areas, this trend may be inverted. That is dependent on what the market is willing to pay a higher rent or property price for in that specific region.

Which cities or states have the lowest or highest Cap rate? Also, why does the cap rate between properties, cities, and states vary?

The cap rate between neighboring cities within the same states can vary as widely as the cap rate amongst properties in different states. The cap rate for properties can vary widely within the same city, even with large-cap rate discrepancies with properties on the same street. Cap rate is directly correlated with the Golden Rule of Real Estate “Location, Location, Location.”

Properties, regardless if commercial, residential, retail, industrial, and so forth, located in a high demand area can command higher sales price than properties in lower demand areas and with lower prospects in demand. The cap rates in metropolitan areas with higher demand for rentals and higher occupancy levels (low vacancy) tend to have lower cap rate values than other cities and regions. Some of the cities with lowest cap rates are coast cities in the East and West such as New York, San Francisco, Los Angeles, Seattle, Boston, Miami, and Washington D.C. Many of these cities or regions have a strong demand for residential, commercial properties due to their strong tech and finance sectors. Other large cities which are not in the East or West coast such as Chicago, Austin, Columbus, Indianapolis, Denver, Nashville, Reno, will also have lower cap rates but which are still higher than the coastal cities. There is no fixed cap rate, and values for properties in a region will fluctuate over time, it will have a lot to do with factors such as the supply and demand of property and property units in an area, and the ability of the region to command rental prices and property purchasing values. The economic strength of a city, state or territory will play have an impact on the Cap Rate, and so will the overall national economy affect what the cap rate in the region in a specific period.

v0.8